Remember to activate and start using your new CapEd Mastercard Debit card. All Visa debit cards are now closed. Learn more about new Mastercard Debit and Credit cards.

Remember to activate and start using your new CapEd Mastercard Debit card. All Visa debit cards are now closed. Learn more about new Mastercard Debit and Credit cards.

Our Rise Youth & Young Adult Savings is an insured, dividend-paying account for young savers, newborn through age 25. It is specially designed to educate our younger members on the importance of saving money. The more they save, the more they're rewarded.

Open a Rise AccountBenefits & Features

- No service charges

- Minimum deposit of $5.00 to secure membership

- Earns dividends

- 1.00% APY1 (on balances up to $2,500)

- Quarterly Statements (Learn how to enroll in eStatements)

- Can be used as Overdraft Protection for checking accounts

- Federally insured by NCUA

Why else is this savings account great for kids?

We want to help our members succeed in every stage of life. That's why the following features and benefits of this account were created to celebrate young savers for their dedication to saving and their membership at CapEd Credit Union.

Help your kids understand financial ownership and responsibility. With Rise, the child is the primary account owner, while their parent or guardian is a joint owner. Ages 16 and older are not required to have a joint owner.

We reward our Rise account holders annually on their account opening anniversary. When a Rise account member saves big, they will receive a $10 automatic deposit into their account for every $500 saved!2

Young savers are welcomed to our credit union with an account opening gift when they open a Rise account.

Rise account young savers will receive a birthday gift each year that can be picked up at any CapEd Credit Union branch.

Rise account holders will receive a savings match up to $25 on deposits made within the first 30 days of account opening. CapEd will deposit the match into the account for money saved beyond the $5 membership minimum deposit.

At account opening, young savers will receive a physical savings punch card. Ten "punches" will earn a gift that can be received at any CapEd location! Savings are also tracked in the Rise App. As Rise members save, they earn virtual trophies and are notified when it's time to visit a branch for a prize.

CapEd offers Overdraft Protection options to cover transactions when you don't have enough funds, resulting in a Courtesy Pay fee. As a Rise account holder, you may qualify for a fee refund with Courtesy Pay Forgiveness.

Link your Rise account debit card to your mobile device with Apple Pay or Google Wallet for easier access to your funds.

Rise Youth & Young Adult Savings Rates

Rise Youth & Young Adult Savings Rates

| Account Balance | Dividend Rate | APY1 |

|---|---|---|

| $5.00 - $2,500.00 | 1.00% | 1.00% |

| Over $2,500.00 | 0.10% | 0.10% |

Minimum Balance to Open Rise savings account.

$5.00

Monthly Service Fee for Rise savings account.

$0.00

Highest Dividend Available for Rise savings account.

1.00% APY1

Request a Rise Savings Account

Easily apply online to open a Rise Youth & Young Adult Savings account, or stop by one of our locations to start the process.

Apply OnlineRise App in CapEd eBanking

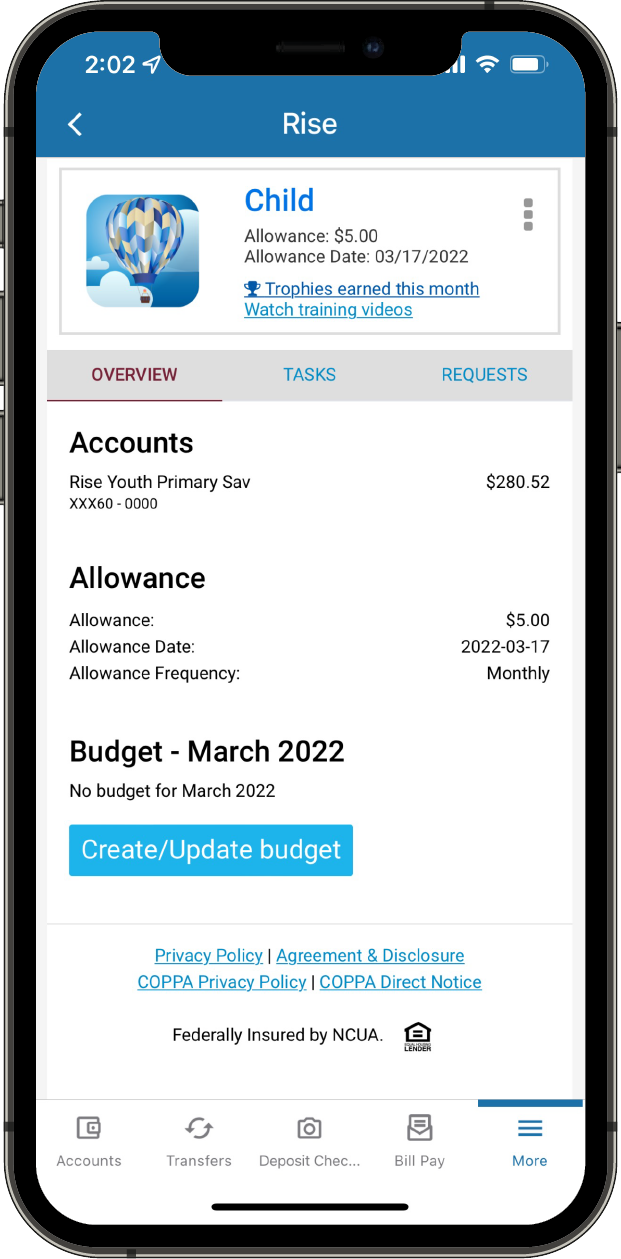

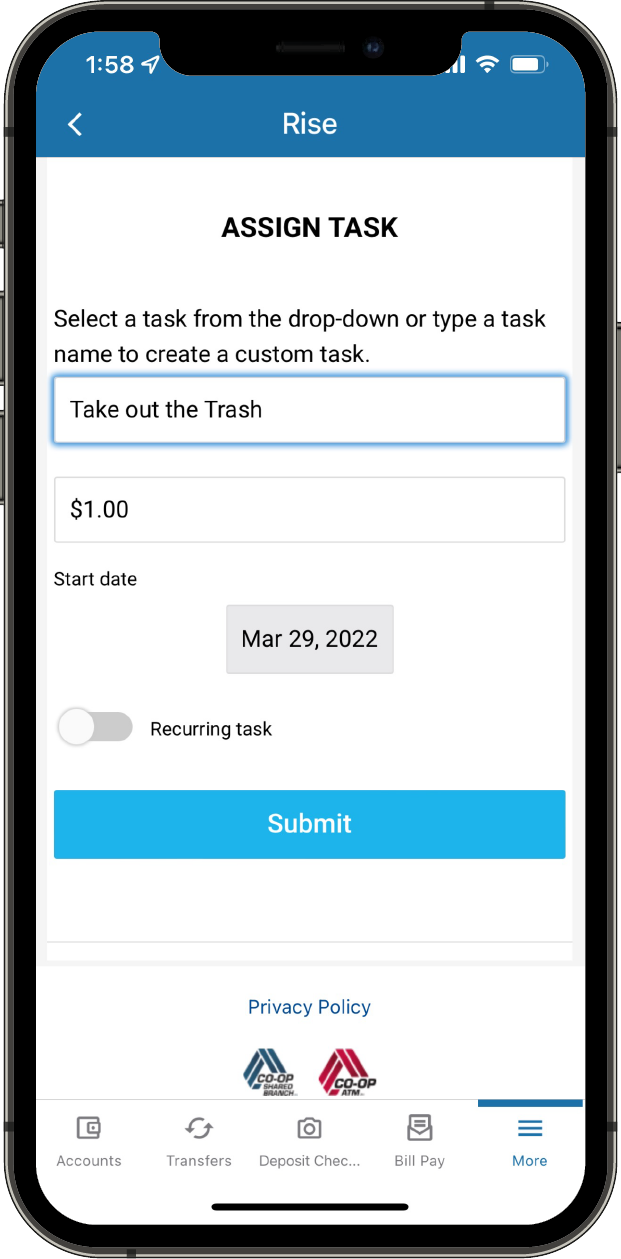

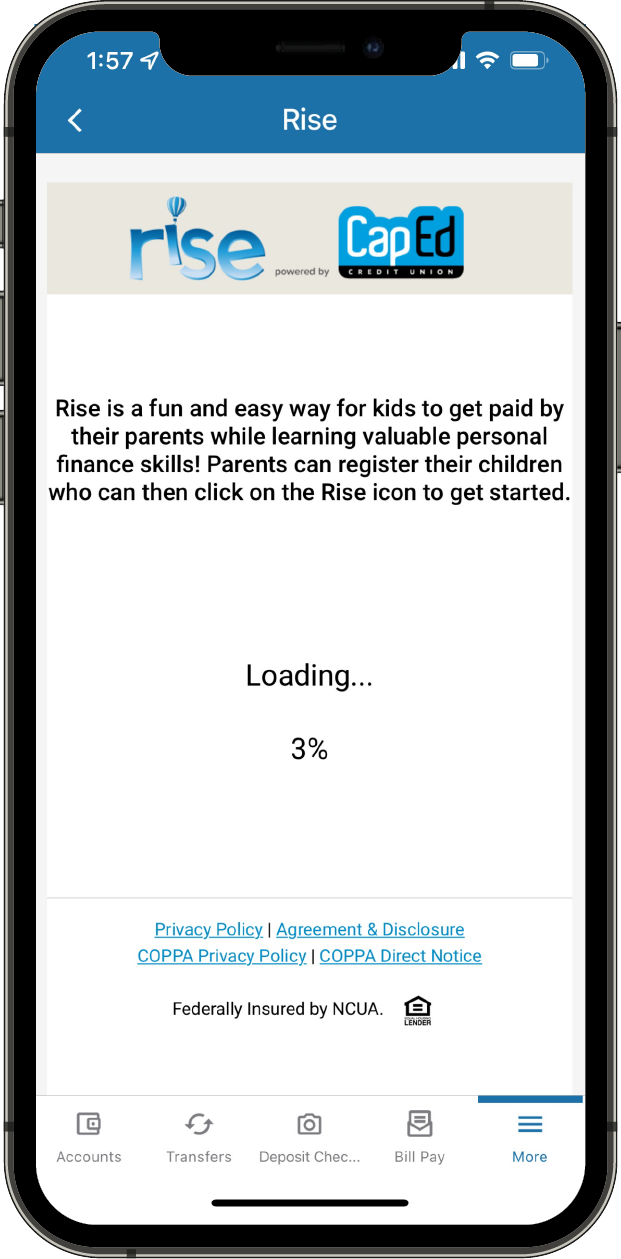

The CapEd Rise App in eBanking is a customized financial education tool for youth under age 18 that encourages and teaches kids how to use savings and checking accounts. Designed to integrate with CapEd's Rise Youth and Young Adult Savings account, the app works as a communication tool, a reward system, and a motivator for children to learn positive money management principles.

Rise App Benefits & Features

Account Utilization

Track funds from in-branch deposits, mobile deposits, transfers from a parent or guardian's joint account, automatic payments for completed chores, and loan payments made to a parent or guardian's account.

Dashboard

Parents and their kids can send messages through the Rise App to request money, complete assigned chores, review grades, and make loan requests.

Allowance Funds

Pay your child an allowance in the Rise App for the chores they complete. Allowances and chores can be created as automatic payments.

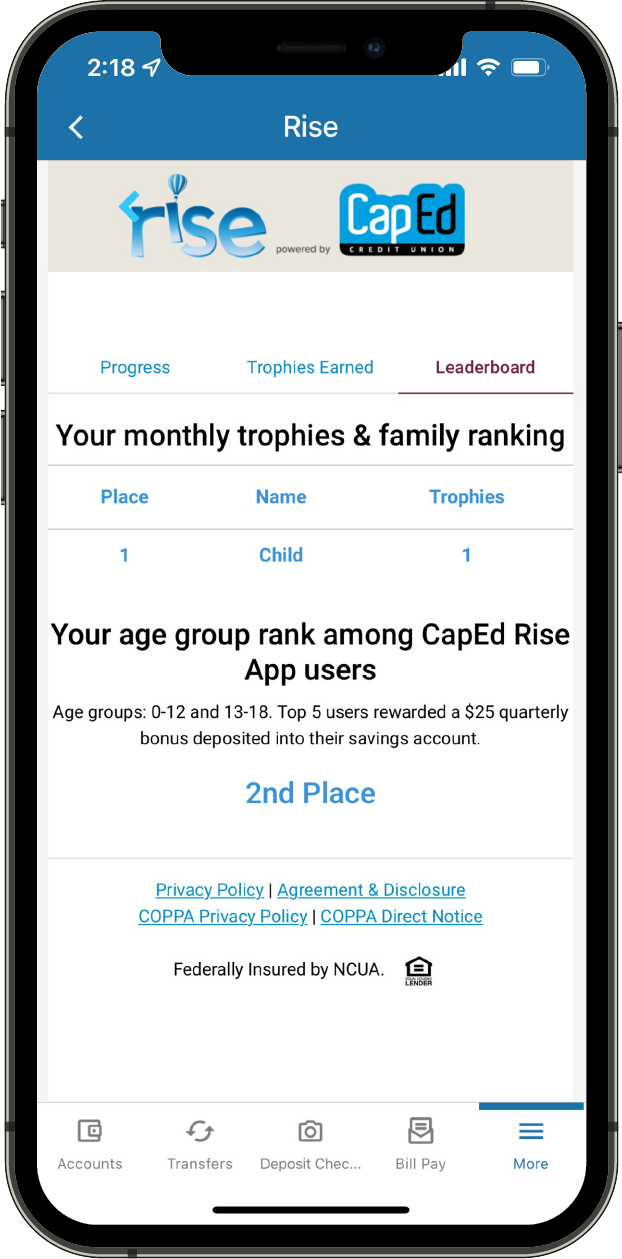

Trophy Leaderboard

Track trophies in the Rise App Leaderboard. The entire family can engage in the fun! Siblings registered in the Rise App can compete with family members to see who's ahead in the leaderboard.

Saving Rewards

Children can earn virtual trophies in the Rise App as rewards for meeting their goals, ranging from saving money and creating budgets, to paying off loans or completing chores.

Resources

Tools to help you with your savings goals.

What will it take to reach your financial goal? This calculator helps you find out.

Determine where your money is going and manage your montly budget with this calculator.

Use this calculator to help analyze your budget as a full-time student.

A certificate option for members under age 26. A minimum deposit of $25 is all that is required for a Smart Step Certificate. 6-month and 12-month options are available. You can make deposits into a Smart Step Certificate at any time.

FAQs

The following is a list of some of CapEd's top member questions with answers to help you meet your needs faster:

Nope! We don't charge a monthly fee. However, there is a minimum balance requirement of $5.00.

Not at all! We want all youth and young adults age 25 and under to have access to this amazing account. Reach out to us on the Let's Talk live chat or stop into any CapEd branch location to convert your child's current Savings account to a Rise Youth and Young Adult Savings.

Absolutely! When a child's parent or guardian helps them open a Rise Youth and Young Adult Savings account, the child can receive their very own debit card to learn to spend their money wisely. The Rise Youth and Young Adult Savings Account is a transactional account, meaning a debit card can be used similarly to a checking account. Funds will be pulled from the Rise Savings account when the debit card is used.

The Rise Youth and Young Adult Savings account is like our primary Savings account in that a minimum balance of $5 is required to maintain membership at the Credit Union. Our youth savings is uniquely designed to be the best start to your child's financial journey with additional features, including a higher dividend rate, an opening deposit match, in-branch gifts, an annual savings bonus, and an eBanking app with additional rewards— just to name a few!

Both the account owner (youth) and joint account owner (parent/guardian) should bring:

- Valid picture ID or Student ID*

- Social Security Number

- Birthdate

- Address

*If child/account owner is too young for a driver's license, and does not have a school ID, the joint signing on the Minor's behalf must be an immediate family member, or guardian, 18 years or older, and must have appropriate identification. If no picture ID or school ID is available, please contact us for required documentation.

A parent or guardian must be a joint signer on their child's account if they are under the age of 16. A child 16 years or older can open an account on their own, without a joint signer.

You can only open one Rise Youth and Young Adult Savings account per primary social security number. If you have more than one child, each child may have their own savings account.

Yes! The Rise Youth and Young Adult Savings account works just like CapEd's other savings accounts and can receive deposits from direct deposit, joint transfers, ATMs, and in-branch deposits.

Of course! A Rise account owner can open a High Yield Checking™ account and enjoy the benefits of those rewards, too.

No need to worry, when a Rise Youth and Young Adult Savings account owner turns 26, their Rise Savings will automatically convert into a primary Savings Account. No action is needed by the account owner.

Questions?

Disclosures

1 APY is Annual Percentage Yield. Rates are accurate as of the last dividend declaration date and may change after the account is opened. Fees or other conditions could reduce the earnings on the account.

2 Earn up to $20 annually for every $500 deposited. New money only.